Switzerland, Dubai, and South Korea: The Best Places for Crypto Business in 2024, According to Social Capital Markets

A Social Capital Markets report highlights Switzerland, Dubai, and South Korea as the best destinations for crypto business in 2024. What sets them apart is their legal stability, reasonable capital gains taxes, and high acceptance rates for Bitcoin and altcoin payments.

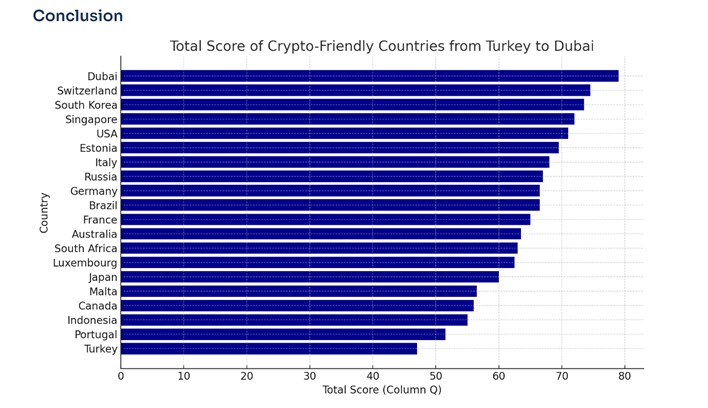

The report evaluated countries based on several criteria: clarity of laws, capital gains tax, corporate tax, the number of registered crypto companies, and adoption rate. Dubai, Switzerland, and South Korea topped the rankings, scoring 79, 74.5, and 73.5, respectively, out of 100. Singapore, the United States, Estonia, Italy, Russia, Germany, and Brazil follow them.

In Dubai’s case, the analysis focuses on two key factors: no income tax and a reasonable corporate tax rate of 9%. Notably, Dubai relies on two regulatory entities—the Virtual Asset Regulatory Authority (VARA) and the Dubai Financial Services Authority (DFSA)— to maintain a clear and supportive legal environment for crypto businesses.

In Switzerland, Social Capital notes that there are over 900 registered crypto companies, with a capital gains tax of 7.8% and a corporate tax rate ranging from 12% to 21%. The country has established a clear regulatory framework for crypto, implementing laws since 2018 to oversee ICOs and other sector aspects.

- We highly recommend checking out this post: Prime Crypto Destinations: Key Hubs for Business Advancement.

Finally, the report notes that South Korea is still developing its regulatory framework, yet it already boasts 376 registered crypto companies. To provide crypto services in the country, companies must register with the Financial Services Commission (FSC) and comply with its regulations.

With the deadline for capital gains tax extended and a corporate tax set to roll out in 2025, South Korea is now providing tax relief that could attract new businesses. Moreover, the country is looking into initiatives like central bank digital currencies (CBDC), which may enhance regulatory clarity and strengthen the business environment.

“The crypto industry is profitable and increasingly acknowledged by many countries as the future of digital investments.

To join this crypto wave, countries are developing laws and regulations that support crypto businesses while protecting their citizens’ interests.

G20 countries lead in creating crypto-supportive regulations, but even countries that aren’t G20 members are not far behind, offering intense competition”.